Rechercher dans ce blog

Sunday, January 31, 2021

All aboard the stock-market solar coaster - Fox Business

Jon Oringer, Shutterstock executive chairman and Pareto Holdings founder, calls Miami a ‘business-friendly environment’ that is welcoming tech startups and companies looking to relocate.

Solar stocks are sizzling—quite an accomplishment for the simplest and most mature of the green-energy technologies. Finding companies that could keep shining might require looking in less obvious places.

Continue Reading Below

The MAC Global Solar Energy Index has generated a 233% return including dividends for dollar investors during the past year. That is well ahead of returns from wind-turbine makers Vestas and Siemens Gamesa, nevermind the S&P 500’s 15%.

As public and political support for green power has broadened, markets have come to expect a decadeslong renewables rollout. It is hard to see any catalyst for a change in sentiment, says Sam Arie, a veteran utilities analyst at UBS. Solar panels can be the cheapest way to generate electricity in many parts of the world. “In some cases it is even cheaper to build a new solar farm than run existing coal plants,” says Alex Monk, a portfolio manager at asset manager Schroders.

PROVING GAMESTOP MANIPULATION WILL BE TOUGH FOR SEC, OTHERS

The catch is that the shift to renewables doesn’t guarantee shareholder returns. To justify high valuations, investors need to ensure companies have a defensible business as well as growth prospects.

Solar investors have already experienced at least two stomach-churning cycles. A key lesson has been that making panels themselves is a low-margin, hypercompetitive market best avoided. But other parts of the value chain offer better prospects.

For example, SolarEdge and Enphase make power inverters, which convert a solar panel’s power to alternating current and adjust performance to maximize output. Their Nasdaq-listed shares have returned 179% and 444% respectively during the past year and now trade for 72 and 93 times forward earnings. That is a lot of growth priced in. However, the technologies are patent-protected and could also be central to managing a smart home’s power between electric vehicles, solar panels, batteries and the like—a potentially vast market.

Developers are another option. They bid for, build and run solar farms. While installing the panels isn’t complex, experience is valuable when pricing bids and navigating the permitting process, and scale is crucial to sourcing panels effectively.

TOYS R US RETRENCHES AGAIN, SHUTTERS ITS LAST 2 US STORES

NextEra Energy, NEE -1.93% Enel ENEL -2.50% and Iberdrola IBDRY -1.86% have built huge renewable-power farms as part of wider utility businesses and have ambitious rollout plans for solar and wind. Their shares have given investors total returns of between 16% and 28% over a year, and now change hands for between 15 and 32 times forward earnings. Barclays utilities analyst Dominic Nash credits part of the rise to general growth investors coming into the sector for the first time.

Then there are U.S. residential developers, which offer homeowners rooftop solar-panels paired with battery storage. The products provide added reliability, and monthly payments for the cost of batteries and solar panels that are often lower than existing utility bills. “It’s a pretty easy sale,” says Stephen Byrd, an analyst at Morgan Stanley.

Shares in SunPower SPWR 2.12% and Sunrun, two such developers, trade at Tesla-type multiples, 118 times and 360 times forward earnings respectively. Revenues will grow—U.S. solar penetration will rise from 3% now to 14% by 2030, says Mr. Byrd—but margins will also come under pressure once installers compete head-to-head rather than with incumbent utilities.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Investors need to choose carefully as the stock-market solar coaster speeds up again. The general direction of travel may be up, but it likely still has plenty of twists and turns in store.

"Market" - Google News

February 01, 2021 at 04:10AM

https://ift.tt/2YzEvKY

All aboard the stock-market solar coaster - Fox Business

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Dow futures drop 150 points, building on losses after worst week since October - CNBC

U.S. stock index futures declined in overnight trading as a surge in speculative trading by retail traders continued to cause hedge funds to take off risk and worried investors about a market bubble. The losses build on last week's decline, which was the worst for the market since October.

Futures contracts tied to the Dow Jones Industrial Average declined 100 points, or 0.33%. S&P 500 futures slipped 0.45%, while Nasdaq 100 futures fell 0.62%.

Tobias Levkovich, Citigroup's chief U.S. equity strategist, believes the market's valuation is stretched and that the recent turmoil fueled by retail traders is the kind of thing that could spark the start of a correction from these overvalued levels.

"We think that the vulnerabilities are there, and while we do not know precisely which catalysts might emerge or their exact timing (including some of the recent retail-oriented pushes against heavily shorted stocks), we suspect that they would derail the current rally and provide entry points that may be 10% lower," he wrote in a note to clients.

Futures contracts for silver surged on Sunday night, indicating that the Reddit boom is spreading to other areas of the market. Silver is a popular topic on Reddit forum WallStreetBets

The Dow dropped 620 points on Friday, or 2%, to close below the 30,000 level for the first time since December. The Nasdaq Composite also slipped 2%, while the S&P 500 fell 1.9%.

For the week, all three major averages slipped more than 3% for their worst weekly performance since October. The Dow and S&P also posted losses for January — the first negative month in four — although the Nasdaq did manage to post a gain for the month.

Friday's dip came amid a frenzy of activity by retail investors in heavily-shorted stocks including GameStop and AMC Entertainment, which fueled concerns about the overall health of the market. Goldman Sachs noted that the current short squeeze is the worst in 25 years.

"This week's events may have turned markets on their heads, but fear indicators imply that we may have seen the worst of the degrossing," Jefferies wrote in a note to clients over the weekend. Barclays added that it's unlikely that the impact of the short squeezes will ripple through the broader market.

"The ongoing short squeeze in a few stocks by retail investors has raised concerns of a broader contagion," the firm wrote in a recent note to clients. "While we believe there is more pain to come we remain optimistic that it is likely to remain localized."

Meanwhile, a group of 10 Republican senators sent President Joe Biden a letter on Sunday, urging him to consider a smaller, scaled down Covid-19 relief proposal. His current plans calls for $1.9 trillion in additional fiscal stimulus. The alternative proposal comes after House Speaker Nancy Pelosi said the chamber will move to pass a budget resolution, the first step toward approving legislation through reconciliation. The process would enable Senate Democrats to approve an aid measure without GOP votes.

Elsewhere, another busy week of earnings is coming up with 99 S&P companies set to report. Alphabet, Amazon, Alibaba, Snap, Exxon, Biogen, Pfizer and Chipotle are among the names set to report this coming week. Thursday is the busiest day of the earnings season.

"We believe the medium-term path for the market remains higher," noted Mark Haefele, global CIO at UBS Wealth Management. "In a similar pattern to the previous two quarters, corporate earnings for 4Q20 are exceeding expectations by a significant margin."

He added that a stimulus package as well as investors looking beyond delays to vaccine production and distribution should further boost stocks.

- CNBC's Jacob Pramuk contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

"Market" - Google News

February 01, 2021 at 06:03AM

https://ift.tt/3cthwK0

Dow futures drop 150 points, building on losses after worst week since October - CNBC

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Stock Market Today: Dow, S&P Live Updates for Feb. 1, 2021 - Bloomberg

U.S. equity futures fell Monday and Asian stocks were mixed amid lingering concerns about the impact of retail trading and disappointing economic data from China. Silver futures surged in the latest manifestation of retail investor enthusiasm.

S&P 500 contracts dropped as much as 1% before paring losses. The U.S. benchmark closed about 2% lower on Friday amid concern about the implications of short-squeezes encouraged on internet forums. Silver futures opened more than 7% higher after the metal became the latest focus of such chatter.

Stocks saw modest gains in Japan and South Korea and retreated in Australia. Data suggested China’s recovery -- one of the bright spots in the global economy -- is being hampered by efforts to curb Covid-19. The dollar edged higher against major peers. The Australian dollar slipped after Perth in Western Australia state went into a five-day lockdown due to a coronavirus case. The yield on 10-year Treasuries was little changed around 1.07%.

Global stocks retreated last week as retail trading created havoc in some U.S. shares and traders mulled an uncertain outlook for deploying coronavirus vaccines. Over the weekend, data showing a slowdown in Chinese manufacturing provided a reminder to investors that the global economic recovery from the pandemic remains fragile.

The spike in silver comes as retail sites were overwhelmed with demand for bars and coins on Sunday. Comments began appearing on Reddit forum r/WallStreetBets last week as people suggested buying exchange-traded funds linked to silver.

“You have a number of players out there who are finding hedge funds and others with short positions and they’re corralling thousands of investors to squeeze them out,” Scott Crowe, chief investment officer at Centersquare Investment Management LLC, said on Bloomberg TV. “I caution the thinking that this is just a one-off -- we are already talking about silver this morning.”

Meantime, in China, the central bank indicated it won’t drive up borrowing costs further after concern grew about a cash squeeze. The country’s purchasing managers’ indexes showed Asia’s largest economy extended its expansion in January but lost speed more abruptly than expected.

These are some key events coming up:

- Earnings season is full steam ahead as companies report results, including Alibaba, GlaxoSmithKline, Ferrari, Exxon Mobil, BNP Paribas and Yum! Brands.

- The Reserve Bank of Australia’s policy decision comes Tuesday.

- Wednesday sees the EIA crude oil inventory report.

- The Bank of England sets rates on Thursday and an Indian central bank policy decision comes then too.

- The U.S. January payrolls report is due Friday, providing a first look at hiring in 2021.

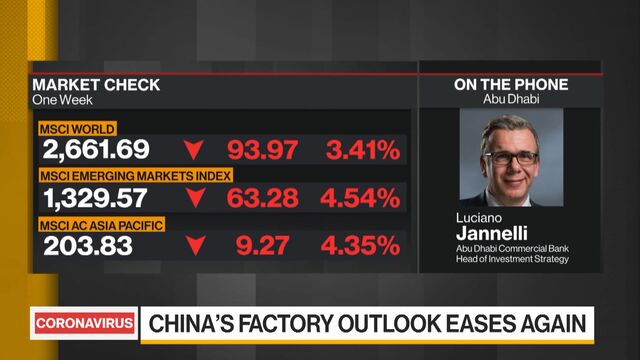

Luciano Jannelli, Head of Investment Strategy at Abu Dhabi Commercial Bank, discusses the GameStop frenzy hitting global stocks.

Source: Bloomberg

Here are the main moves in markets:

Stocks

- S&P 500 futures lost 0.7% as of 9:03 a.m. in Tokyo. The gauge fell 1.9% on Friday.

- Japan’s Topix index rose 0.3%.

- South Korea’s Kospi added 0.1%.

- Australia’s S&P/ASX 200 Index sank 1.1%.

Currencies

- The yen dipped 0.1% to 104.75 per dollar.

- The offshore yuan was at 6.4542 per dollar.

- The euro bought $1.2123.

- The Aussie slipped 0.3% to 76.25 U.S. cents.

- The kiwi declined 0.4% to 71.66 U.S. cents.

Bonds

- The yield on 10-year Treasuries was at 1.07%.

- Australia’s 10-year yield rose two basis points to 1.15%.

Commodities

- Silver futures rose 6.8% to $28.75.

- West Texas Intermediate crude slipped 0.3% to $52.03 a barrel.

- Gold rose 0.4% to $1,854.83 an ounce.

— With assistance by Joanna Ossinger

"Market" - Google News

February 01, 2021 at 03:58AM

https://ift.tt/3ctZI1s

Stock Market Today: Dow, S&P Live Updates for Feb. 1, 2021 - Bloomberg

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

When Ted Cruz and A.O.C. Agree: Yes, the Politics of GameStop Are Confusing - The New York Times

From the populist right to the socialist left, the rush by both parties to side with young traders disrupting the markets reflects the broad recognition of the impulses driving American politics.

It’s Occupy Wall Street, the sequel. It’s elements of the Tea Party, again. It’s Bernie bros and MAGA-maniacs.

The hordes of young traders who this week fueled a spectacular surge in the value of the video game retailer GameStop may lack a unified political ideology. But they have forced a reckoning on Wall Street, and caught the attention of leaders in Washington who recognize a populist uprising when they see one.

Wall Street has long been an easy villain for many on Capitol Hill. But the rush to side with speculative traders by both Democrats and Republicans reflects the broad recognition of the impulses that have driven American politics in recent years, fueling both the ascension of President Donald J. Trump and a liberal wing of the Democratic Party that grew stronger in opposition.

The decision by the online brokerage app Robinhood to impose trading limits as hedge funds were hammered by the wild market fluctuation has prompted the rarest of all political occurrences — bipartisan agreement. Lawmakers from across the political spectrum condemned the move and called for hearings into the decision, among them Senator Ted Cruz of Texas, a Republican and staunch conservative, and Representative Alexandria Ocasio-Cortez of New York, a standard-bearer of the left. The conservative attorney general of Texas and his progressive counterpart in New York have both initiated inquiries into Robinhood.

“For years, the stock market has been less and less about the value of business and more and more like casino gambling,” said Senator Elizabeth Warren, Democrat of Massachusetts, who called for increased regulation of Wall Street shortly after the market frenzy over GameStop began this week.

“GameStop is just the latest and most visible example,” she said in an interview on Friday. “We need to take this not as a one-off problem but as a systemic problem that requires systemic regulation and enforcement.”

While President Biden defeated Mr. Trump with a centrist message of restoring political norms, the trading frenzy this week provided a potent reminder of the strong undercurrent of grievance and institutional distrust in the country. Many believe that will only intensify as the nation wrestles with the economic fallout from a devastating pandemic.

As Wall Street booms, unemployment has hit record highs with nearly 10 million fewer people holding jobs than at the beginning of last year — a situation that reminds some former officials of the 2008 economic crisis that led to both the Occupy Wall Street and the Tea Party movements.

“It’s not about Republicans and Democrats,” said Newt Gingrich, the former Republican House speaker and an ally of Mr. Trump. “It’s lots and lots of normal, everyday people who began to figure out they really got ripped off for the last year just like they got ripped off in 2008 and 2009.” He added, “What you’re seeing is an almost spontaneous cultural reaction in which the little guys and gals are getting together and going after the bigs, so the bigs are having to rig the game in order to survive.”

The reality is more complicated. There’s little sign of any central political mission shared by the millions of amateur traders who combined to squeeze at least two hedge funds that bet against the stocks of companies like GameStop and the movie chain AMC. One of the originators of the scheme is far from a “little guy,” with the financial resources to allegedly transform an initial investment of $53,000 into $48 million. Over all, only about half the country owns any stock at all.

On Reddit, the online site that helped fuel the surge, few of the mostly young participants frame their flood of investments in clearly partisan terms. Yet many write of being driven by anger over the 2008 financial bailouts that kept the big banks afloat while 10 million Americans lost their homes.

“When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year,” one person identified as ssauronn posted on Reddit. “Your ilk were bailed out and rewarded for terrible and illegal financial decisions that negatively changed the lives of millions.”

Other posters responded with their own stories of economic struggle and political rage.

“Forget republican/democrat, left/right… the bankers play both sides and have almost always come out on top,” a poster identified as ChrisFrettJunior wrote, after recounting watching his parents struggle through the 2008 recession.

The decision to bail out the biggest banks and also decline to prosecute any of their top executives led to much of the populist fervor that has driven American politics in the past decade. The Tea Party surged to political prominence in the wake of the $700 billion financial rescue package that passed in 2008, eventually becoming a force that defeated both moderate Republicans and Democrats.

After Republicans won control of the House in 2010, Democrats began to face their own backlash, beginning with Occupy Wall Street — a loose coalition of largely liberal protesters who fueled a national conversation about economic inequality.

These days, political strategists warn, hedge funds, private equity investors and bankers are unlikely to find the same kind of deep support in Washington. Anger over the bailouts fueled the campaigns of political outsiders, creating a Congress that’s less receptive to the pleas of Wall Street and far more eager to make use of upheaval to advance lawmakers’ agendas.

“There’s a ton of political currency in holding hedge funds’ feet to the fire from Democrats and Republicans,” said Josh Holmes, a Republican strategist and longtime adviser to Senator Mitch McConnell. “If you’re sitting on Wall Street looking at this, dismissing people as folks who don’t understand the way that the markets work, I think you’re going to be in a lot of trouble.”

For Republicans, the market upheaval was a referendum on elitism. Democrats saw pure corporate greed and the need for greater regulation.

“Big Hedge, with outposts in South Hedge-i-stan (Wall Street) and North Hedge-i-stan (Greenwich, CT), has made trillions shorting great American companies facing a rough patch,” said Representative Jeff Fortenberry, Republican of Nebraska. “Now they are getting a comeuppance from flash mobs of day traders and are paying dearly.”

Most of the ire this week was directed at Robinhood, a brokerage app catering to younger investors, which suddenly limited trading in GameStop, AMC and other stocks. Lawmakers argued that the app was protecting hedge funds and other big investors over retail investors. Robinhood said the additional restrictions were necessary to comply with government financial requirements.

Yet even centrists like Senator Pat Toomey of Pennsylvania, who is poised to become the top Republican on the Senate Banking Committee, expressed concerns about the lack of transparency in the online company’s decision making.

“I find it disturbing when retail investors who are simply seeking to buy a stock are frozen out of the market,” Mr. Toomey said in a statement. “Retail investors should be free to purchase even highly speculative stocks, just as hedge funds should be free to short them.”

Though politicians from both sides joined calls for greater scrutiny, it was hardly a kumbaya moment for the two parties.

After Mr. Cruz tweeted that he agreed with Ms. Ocasio-Cortez’s call for a probe into Robinhood’s action, she quickly disavowed any support from the Texas Republican, who was a prominent backer of Mr. Trump’s baseless claims of election fraud.

“I am happy to work with Republicans on this issue where there’s common ground, but you almost had me murdered 3 weeks ago so you can sit this one out,” she responded. “Happy to work w/ almost any other GOP that aren’t trying to get me killed. In the meantime if you want to help, you can resign.”

Mr. Cruz condemned her response as “partisan anger” that’s “not healthy for our country,” drawing another response from Ms. Ocasio-Cortez, while his allies in the House called for an apology.

The uproar over GameStop and Robinhood comes at a challenging time for the Biden administration, which took office promising to restore a sense of calm to the country. The Senate Banking Committee has yet to schedule a hearing to confirm Gary Gensler, Mr. Biden’s pick to lead the Securities and Exchange Commission, leaving the agency with an acting chair for the indefinite future. On Friday the White House press secretary, Jen Psaki, deferred questions on the issue.

“It’s a good reminder, though, that the stock market isn’t the only measure of the health of our economy,” she said, an apparent reference to Mr. Trump’s persistent fixation on stock prices during his tenure. Mr. Biden has not yet commented on the issue.

Representative Ro Khanna of California, a progressive who represents a district that includes Silicon Valley, said this week’s events should alert lawmakers to the need to tighten financial regulations and increase transparency and equity.

He said the wide range of Republicans and Democrats who have spoken out are a reflection of “a real populist anger in this country.”

“Some people go get fancy degrees, know the right people, and spend all day in front of their computers short selling,” Mr. Khanna said. “And it’s a form of manipulation that has hurt our country. That has enriched the few at the expense of many Americans.”

Though many Americans own no stock at all, the sense that Wall Street has gamed a rigged system cuts across demographic barriers, he argued.

“I think this has been bubbling up since the Wall Street crash of 2008,” Mr. Khanna said. “And it’s coming to a boiling point.”

"politic" - Google News

January 31, 2021 at 05:00PM

https://ift.tt/39ymjYE

When Ted Cruz and A.O.C. Agree: Yes, the Politics of GameStop Are Confusing - The New York Times

"politic" - Google News

https://ift.tt/3c2OaPk

https://ift.tt/2Wls1p6

Fed's Powell just talked up a classic Buffett market bogeyman: Inflation - CNBC

During extended bull markets it becomes easy to believe the path of least resistance is up, and harder to see the risks that could whipsaw stocks. Take January 2020, when investors remained confident even as stock valuations were already being viewed as stretched. That was right before reports about a virus in China began to surface. This month, the path of least resistance again seemed up, until Reddit and Robinhood and GameStop gave the market its latest example of a black swan reminder that there is always something out there you won't see coming.

What's not a surprise is that investors panicked. Sophisticated Wall Street trading instruments that are opaque to the investing masses and risk of hedge fund failures rippling through the market are flash points for past crashes, from Long-Term Capital Management to the subprime mortgage crisis.

There will always be new market risks. Others, though, should be easier to spot coming. Inflation, for example, which is a classic market bogeyman.

"The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures," Warren Buffett once wrote. "The inflation tax has a fantastic ability to simply consume capital. ... If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker — but not your partner."

Warren Buffett and the worst inflation

Buffett lived and invested through some of the worst inflation ever in the 1970s. And before the 2008 crash, he warned that $4 gasoline was a not a good sign for anyone. But he also warned that the Fed's printing of unlimited money after the crash would have unintended consequences. One has been maybe an inflated stock market, but actual inflation has remained low and Buffett has more recently said, no economics textbook of the past 100 years can explain this market.

As GameStop makes investors fear that there is a new normal in the market with unknown consequences, is inflation a classic market bogeyman that no longer has the power it once had? It would have been easy to miss Federal Reserve chair Jerome Powell this past week on inflation, but he was talking it up — and at the same time, sort of talking it down.

"Frankly we welcome slightly higher, somewhat higher inflation. The kind of troubling inflation people like me grew up with seems unlikely in the domestic and global context we've been in for some time," Powell said after the Fed's most recent FOMC meeting.

Though inflation remains low, investors worry that the Fed could start to taper its market purchases unexpectedly should conditions change and that could cause another period of market tumult. Even if the GameStop shock goes away, will there be a more classic factor for investors to worry about?

Powell pledged that the market will get plenty of guidance before any tapering actually happens. "When we see ourselves getting to that point, we'll community that clearly to the public so nobody will be surprised when the time comes," he said on Jan. 27.

The Fed has been signalling for some time that its policy on rates and inflation is part of a new policy normal, and it will tolerate higher levels even as employment rises and the economy runs hotter. The truth is that inflation has been in secular decline for decades, says Nicholas Colas, co-founder of DataTrek Research, and even all the money printing post-financial crisis failed to spark it. Inflation seems to retain more power as a political sound bite, especially among Republicans, than as a market force.

As Colas likes to point out, using a visual aid, if the following chart were a stock chart, would you buy it?

"Most answer 'no,'" Colas said.

And Colas says it is hard to imagine rampant inflation with an aging, low growth population. "The experience in Europe and Japan sort of says no. U.S. population growth down to 0.3%. Average age rising. And China actually has worse demographics than the U.S. on this count. How do we get global inflation with slower household formation and overall pop growth?"

That doesn't mean investors won't continue to worry. The older and more conservative an investor is, the the more this issue may stay in focus whenever markets get back to more traditional worries — not pandemics and trading revolutions born on Reddit.

But Colas says that investors should understand a few important things about the new world and inflation. For starters, an inflated stock market does not mean there is financial inflation.

"Lots of people think goods inflation (CPI, PCE) has been replaced by financial asset inflation;" Colas wrote in a recent research report. "Is that really a thing? Not really. Financial assets are priced on expected future cash flows and discount rates. CPI/PCE measure the prices of things that get consumed (no cash flows to discount). You can think the stock market is overvalued, but calling that inflation is wrong. In fact, inflation can help future earnings and make stocks more valuable."

The Fed says expect inflation, but don't worry about it

Inflation is coming.

"We will see higher comps soon," Colas said. "Powell talked about how a resurgence in consumer spending might drive inflation. The back half of the year we will see consumer inflation higher. ... Powell acknowledged that."

And in some ways, the setup for inflation is similar to that dark period of the 1970s when Buffett and so many other investors of older generations became permanently afraid of its power. Colas noted that during the fiscal spending of the Great Society and Vietnam War era the Fed did not want to pursue any policy that seemed to be at odds with either social progress or a war, which can be compared to the present war against the Covid-19 virus and the government spending on it amid rising economic inequality and concerns about social justice.

The Fed predictions market doesn't expect the central bank to soon get any more brave about taking on that environment. The Fed funds rate tracker has the chance of a rate increase by 2022 recently pegged between zero and 10%, Colas said.

An initial phase of inflation could even be good for stocks, giving companies more pricing power and as a result better earnings. Between the current Fed outlook and that initial inflation influence on the market, Colas says that if GameStop turns out to be a "footnote" — though all bets are off on that for the moment for those who don't want to be on the wrong side of the market's most powerful current force — then stocks should be able to continue up.

Inflation indicators to watch

There are some inflation indicators that investors should keep in mind.

Gold demand is one. Flows into gold funds went negative in Q4 2020 after peaking in Q2 and Q3 2020. According to Colas, "If funds flow go positive in gold funds again, maybe that would mean inflation. ... but there's not much happening now."

Bitcoin is the "new gold" to watch, but its meteoric rise last year and into this year was more a function of institutional buyers buying into the cryptocurrency than inflation fears, he surmises.

Traditional currency markets are also to be watched. In the 1970s, the German and Japanese currencies rallied every year of the decade. "The yen and the deutschmark rallied all the way through. Marginal global investors were saying inflation is too high in the U.S. and we are not getting paid for risk," Colas explained.

The analog now is the Chinese yuan. It is in the middle of its 10-year band now, but if the yuan were to move up a lot, say 10% to 20%, that would suggest that global investors are worried about the medium- term outlook for U.S. inflation.

The Fed's power will be key as well. When the 10-year yield rises even when "the Fed is putting its finger on the scale," that's a danger sign.

"Stock valuations are a function of cash flows and rates and that's it. So if rates go up, stocks go down, unless the earnings growth rate is faster than the risk free rate," Colas said.

Some market experts say the current Gamestop panic has been spurred by a Federal Reserve policy that has provided too much support for stocks, and too little opportunity for savers given low rates, while stimulus checks have led more stuck-at-home, and unemployed, Americans to day trade on their futures. The current market battle is about much more than just that, though it is true that the high-yield online savings accounts that attracted a lot of attention in recent years have seen their rates sink. As inflation stays low, it's high short interest on stocks that you could say — to use a term often associated with inflation — has spiked. The subreddit WSB (wallstreetbets) group has passed 7 million subscribers. If actual inflation is next, there are reasons to believe that investors should at least be able to have a better handle on it.

"Market" - Google News

February 01, 2021 at 12:23AM

https://ift.tt/2YvSDFb

Fed's Powell just talked up a classic Buffett market bogeyman: Inflation - CNBC

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

China Looks to Tame Its Booming Property Market. Real-Estate Stocks Took a Hit. - Barron's

Guests look at the showroom of the Country Garden Holdings Forest City Industrialized Building System facility in Johor, Malaysia.

Nicky Loh/BloombergLast week it was Shanghai, now it’s most major Chinese cities. China’s government housing authorities have told local officials to immediately crack down on real estate speculation.

The moves come after a surge in residential housing prices over the last several months, just as China began to control the coronavirus and loan prices were low. In fact, sales plummeted in early 2020, and after China recovered, they surged so high so fast that both property transactions and prices hit their highest levels China has ever recorded, according to the country’s National Bureau of Statistics.

For instance, the prices of homes in the second-tier city of Xiamen, in southern China, is comparable to those in London. Yet the average salary in Xiamen is a fraction of that in London.

China has long been worried about its housing bubble, and has taken previous measure to cool the market. But the last announcement—which limits the amount prospective buyers and builders can borrow—are among the most stringent ever.

The issue is largely a big-city problem. Many lower-tier cities and rural areas are full of empty housing units—earning them the nickname “ghost cities”—mostly due to migration to big cities where the economies and job prospects are far better.

Beyond easy loans and property seen in China as a smart investment, other factors are driving the trend, said one scholar who studies China’s housing market.

“The recent surge in the residential real estate market in major cities is mostly associated with properties located in the catchment area of high quality public schools, at least in cities such as Beijing, Shanghai, and Shenzhen,” said Hanming Fang, the Joseph M. Cohen Term Professor of Economics at the University of Pennsylvania. Prices for properties in areas that don’t have assigned schools are stable, he said.

“The price surge is a surge in the price for scarce educational resources,” he said. To fix the problem and curb property market speculations, the educational resource allocation mechanisms should be reformed, he said, either by making school resources favor lower-quality schools or by tying school resources to local property taxes. Public resource allocations on hospitals, colleges, parks, and other public goods should also be more equitable, he said.

Speculation, too, has frustrated Chinese officials. In a recent visit to Shanghai, China’s deputy housing minister, Ni Hong, told city officials that “homes are for living in, not for speculation,” a statement that was carried widely by state media.

Meanwhile, property-related stocks in China had a bad week. The share prices for the country’s three biggest property developers have been hit especially hard since the recent restrictions were announced. Hong Kong-listed China Evergrande Group (ticker: 3333.Hong Kong) has fallen 12% in the last four days. Country Garden Holdings (2007: HK) has seen an 8% decline in the same period, as has Shanghai-listed Greenland Holdings (600606: China). Most other big developers have experienced similar declines.

Some experts see potential upside to cooling the market beyond just containing the bubble.

“Despite 2.3% increase in GDP in 2020, China’s domestic consumption actually was lowered by 3.9%, partly because of rising investment demand stimulated by rising price in housing and other assets,” Li Gan, professor of economics at Texas A&M University, told Barron’s. “Policies to stabilize the housing market may also help boost domestic consumption.”

Local authorities have resisted previous efforts to tame housing sales, which account for a significant source of local-level revenue.

“This is an important signal but overall nothing new since the policy became more localized and targeted to curb perceived excesses,” said Robert Ciemniak, founder and CEO of Real Estate Foresight, a Hong Kong-based research and analytics firm focused on China property markets. “Tighten where it’s too hot, ease where it cools too much. More significant is the tightening on developers’ financing and banks’ lending to real estate, and how it will play out over time.”

Tanner Brown covers China for Barron’s and MarketWatch.

"Market" - Google News

January 31, 2021 at 08:30PM

https://ift.tt/3r5mMrc

China Looks to Tame Its Booming Property Market. Real-Estate Stocks Took a Hit. - Barron's

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Facebook is getting pulled into a fight about the politics of Israel - The Verge

On November 10th, a Facebook employee sent out an unusual email to an unknown outside party, hoping to arrange a conversation about how the platform moderated against anti-Semitism. “We are looking at the question of how we should interpret attacks on ‘Zionists,’” reads the letter, whose recipient was redacted, “to determine whether the term is a proxy for attacking Jewish or Israeli people.”

That strange but seemingly innocuous email has set off a firestorm in certain corners of the left. Since Tuesday, activists have been circulating a petition calling on the platform to halt any potential changes to the way Facebook moderates the word “Zionist.” Both sides agree the term is often used as part of racist rhetoric that is accurately described as hate speech and should be removed. At the same time, the term is also used by Jewish critics of specific Israeli policies, particularly the country’s settlement policy. Classifying the term as hate speech would end up stifling those criticisms — at least on Facebook.

Hosted by the progressive group Jewish Voices for Peace (JVP), the petition ultimately drew more than 20,000 signatures, including artist-activists like Michael Chabon, Peter Gabriel, and Wallace Shawn. “We are deeply concerned about Facebook’s proposed revision of its hate speech policy to consider ‘Zionist’ as a proxy for ‘Jew’ or ‘Jewish,’” the petition reads. “This is the wrong solution to a real and important problem.”

Reached for comment, Facebook denied that there are any plans to reclassify the word in its hate speech policy. But at the same time, Facebook did not dispute the authenticity of the email or deny that the platform’s classification of the term “Zionist” was under review — simply saying no decision had been made.

“Under our current policies, we allow the term ‘Zionist’ in political discourse, but remove it when it’s used as a proxy for Jews or Israelis in a dehumanizing or violent way,” said a Facebook spokesperson. “Just as we do with all of our policies regularly, we are independently engaging with experts and stakeholders to ensure that this policy is in the right place, but this does not mean we will change our policy.“

Even without a concrete policy change to respond to, JVP sees Facebook’s email as part of a broader campaign to shift how the platform treats criticism of the Israeli government. “Restricting the word ‘Zionist’ as part of a hate speech policy won’t actually make Jewish people safer,” said Rabbi Alissa Wise, Deputy Director at Jewish Voice for Peace, who said the proposed Facebook change would only “prevent its users from holding the Israeli government accountable for harming Palestinian people.”

“Social media companies should allow people to hold our governments accountable to us,” Wise continued, “not shield governments from accountability.”

The new changes seem plausible in part because of the rapid changes in Facebook’s public policies towards anti-Semitism, many of them positive. In August, Facebook altered its hate speech policy to directly address anti-Semitism after receiving a letter from a coalition of Jewish groups. The revised hate speech policy included a range of specific references to anti-Semitism, including a clause that explicitly classified generalizations about “Jewish people running the world” as anti-Semitic hate speech.

But Facebook didn’t make all the changes requested in the August letter. The signees urged Facebook to adopt a definition of anti-Semitism developed by the International Holocaust Remembrance Alliance (IHRA). But the IHRA standards include a number of provisions that potentially limit criticism of Israel itself, classifying “applying double standards” to the country’s actions or generally “denying the Jewish people their right to self-determination” as anti-Semitic. These same provisions have been the subject of US congressional proposals around anti-Semitism, which were criticized by the ACLU on similar grounds.

In a letter to one of the project’s architects, Facebook COO Sheryl Sandberg said the IHRA definition “has been invaluable” in informing Facebook’s policies, but left the details of the implementation more vague. And Facebook’s current hate speech policy does not mention Israel or Zionism.

Facebook has continued to engage with groups on both sides of the debate, but the ongoing nature of the outreach has raised tempers instead of calming them. Architects of the August letter have continued to pressure Facebook to “fully adopt” the IHRA definition, and it’s unclear how much sway these arguments have within Facebook.

“Facebook’s updates to its hate speech policy haven’t satisfied its IHRA-focused critics, whose goal isn’t to get Facebook to deplatform antisemitism,” wrote activist Lara Friedman in the wake of the August letter, “but to get Facebook to deplatform criticism of Israel.”

"politic" - Google News

January 31, 2021 at 09:30PM

https://ift.tt/3tfvtkq

Facebook is getting pulled into a fight about the politics of Israel - The Verge

"politic" - Google News

https://ift.tt/3c2OaPk

https://ift.tt/2Wls1p6

All Aboard the Stock-Market Solar Coaster - The Wall Street Journal

Solar panels can be the cheapest way to generate electricity in many parts of the world.

Photo: Chris Ratcliffe/Bloomberg News

"Market" - Google News

January 31, 2021 at 10:03PM

https://ift.tt/3pA3ryb

All Aboard the Stock-Market Solar Coaster - The Wall Street Journal

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

World Health Organization team visits Wuhan market where first Covid-19 infections detected - NBC News

WUHAN — A World Health Organization-led team of experts investigating the origins of Covid-19 visited Huanan market on Sunday, the wholesale seafood centre in the central Chinese city of Wuhan where the new coronavirus was initially detected.

The team of experts arrived at Huanan on Sunday afternoon amid a heavy security presence, with additional barricades set up outside a high blue fence surrounding the market.

The WHO experts did not respond to questions thrown at them by reporters gathered at the entrance as their convoy drove into the market. The barricades came down as soon as they had entered.

Public access to the market has been severely restricted since it was shut at the beginning of last year. Before its closure, it was a bustling market comprising hundreds of stalls divided into sections for meat, seafood and vegetables.

Some Chinese diplomats and state media have said they believe the market is not the origin, and have thrown support behind theories that the virus potentially originated in another country.

On Dec. 31, 2019, after four cases of a mystery pneumonia were linked to the market, it was shuttered overnight. By the end of January, Wuhan had gone into a 76-day lockdown.

Experts say the Huanan market still plays a role in tracing the origins of the virus, since the first cluster of cases was identified there.

Download the NBC News app for breaking news and politics

Following a two-week quarantine in the city that ended on Thursday, the WHO team is expected to visit laboratories, markets and hospitals in Wuhan.

No exact itinerary has not been announced, but the WHO has said the team plans to visit Huanan market and the Wuhan Institute of Virology.

The team plans to visit hospitals, laboratories and markets. Field visits will include the Wuhan Institute of Virology, Huanan market, Wuhan CDC laboratory. They will speak with early responders and some of the first #COVID19 patients.https://t.co/Owd6GEBoAj

— World Health Organization (WHO) (@WHO) January 28, 2021

The WHO-led probe in Wuhan has been plagued by delays, concern over access and bickering between China and the United States, which accused China of hiding the extent of the initial outbreak and criticised the terms of the visit, under which Chinese experts conducted the first phase of research.

The team had been set to arrive in Wuhan earlier in January, and China’s delay of their visit drew rare public criticism from the head of the WHO, which former U.S. President Donald Trump accused of being “China-centric."

"Market" - Google News

January 31, 2021 at 06:34PM

https://ift.tt/2YIS6jz

World Health Organization team visits Wuhan market where first Covid-19 infections detected - NBC News

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Gambling? In the Stock Market? I’m Shocked. - The Wall Street Journal

Reddit’s WallStreetBets forum has helped turn the basic theory of markets on its head in the past couple of weeks.

Photo: Tiffany Hagler-Geard/Bloomberg News

"Market" - Google News

January 31, 2021 at 09:03PM

https://ift.tt/3acM7Zi

Gambling? In the Stock Market? I’m Shocked. - The Wall Street Journal

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

3 Things I'm Doing to Prepare for a Stock Market Crash - Motley Fool

The stock market has experienced an unforgettable year. After the S&P 500 lost more than 30% of its value in a matter of weeks during the early stages of the coronavirus pandemic, the market made a remarkable recovery and ended the year at a record high. During the first month of 2021, the market has continued to climb higher and higher.

Some investors believe, however, that all this upward momentum is unsustainable and that another crash is on the way. While it's impossible to predict for sure what the future will bring for the stock market, it's wise to be ready for anything. Here's what I'm doing to prepare my investments for a potential market crash.

Image source: Getty Images.

1. Maintain a strong emergency fund

I always like to have at least six months' worth of savings stashed in an emergency fund just in case I'm faced with an unexpected expense. But during periods of market volatility, it's even more important to have some savings set aside.

During market downturns, stock prices drop. If you're forced to withdraw your investments when prices are lower, you could end up selling them for less than you paid for them, thereby locking in your losses.

You never know when unexpected expenses will arise, and I prefer to play it safe to avoid withdrawing any money from my retirement account. When my dog needed a $4,000 surgery last month, my emergency fund was a lifesaver. Without emergency savings, I might have had to pull that money from my retirement fund. And if stock prices had been at rock bottom when I made the withdrawal, that could have had a disastrous effect on my investments.

2. Continue to invest consistently

No matter what the market does, I plan to continue investing consistently. I have my investments set up so that I'm automatically transferring a set amount from my bank account to my retirement account every week. Even if the market crashes, I'm going to keep investing as usual.

I like this strategy because I'm a long-term investor. It will be decades before I retire, so even if my investments lose value during a market crash, I have plenty of time to let them recover. Also, I invest primarily in low-cost index funds and mutual funds, so there's a good chance my investments will bounce back after a market crash.

It might seem counterintuitive to invest when the market is down, but that can actually be a smart strategy to get more for your money. When the market is down, stock prices are lower. In other words, the stock market is essentially on sale, and you can snag great investments at a discount.

3. Don't try to time the market

Timing the market means trying to buy and sell stocks at just the right moment to make a profit. On paper, it sounds like a smart strategy. If you buy stocks when prices are at their lowest and then sell when the market peaks, you could potentially make a substantial profit.

In real life, however, this tactic is nearly impossible to pull off. Nobody can predict exactly when stock prices will rise or fall. Some talented market forecasters can make solid guesses about what the market will do, but even the best forecasters may be wrong more often than they're right.

For these reasons, I never attempt to time the market. I continue investing each week regardless of what happens. If the market takes a turn for the worse, I just remind myself that it will recover eventually, so there's no need to panic.

Bonus tip: Don't check account balances

I will admit, I have gotten a bit of a thrill out of checking my investment account balances over the past year as stock prices have soared. But during market downturns, I make a point of not checking my accounts. In fact, I will sometimes delete my brokerage app from my phone so I'm not even tempted to check my balance. This doesn't necessarily help me prepare for a market crash, but it does help me get through rough patches without being tempted to sell in a panic.

Regardless of whether the stock market crashes in 2021, I like to be prepared just in case. By making sure my finances are ready for anything, I can rest easy whatever the future may bring.

"Market" - Google News

January 31, 2021 at 06:19PM

https://ift.tt/3j1myyD

3 Things I'm Doing to Prepare for a Stock Market Crash - Motley Fool

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Two Close Friends On Navigating Their Relationship Across A Political Divide - NPR

NPR's Lulu Garcia-Navarro catches up with Alex Uriarte and Steven Cruz, two close friends across the political aisle who have maintained their relationship.

"politic" - Google News

January 31, 2021 at 07:59PM

https://ift.tt/3ox8IoF

Two Close Friends On Navigating Their Relationship Across A Political Divide - NPR

"politic" - Google News

https://ift.tt/3c2OaPk

https://ift.tt/2Wls1p6

Markets Look Like They’re in a Bubble. What Do Investors Do Now? - The Wall Street Journal

"Market" - Google News

January 31, 2021 at 05:30PM

https://ift.tt/2MBhIMi

Markets Look Like They’re in a Bubble. What Do Investors Do Now? - The Wall Street Journal

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

With GameStop, Reddit and Robinhood gamified the stock market - Quartz

The stock market turned into a spectacle to rival Super Bowl LV this week, as retail investors and hedge funds faced off over GameStop stock. Tom Brady and Patrick Mahomes will have a hard time providing as much entertainment to viewers around the world as this latest step in the gamification of financial markets.

Punting on stocks has always had a sporting element: the thrill of placing a bet and watching the game play out. But financial markets now offer a chance for combat as well as entertainment. The element of combat was introduced with the proliferation of hedge funds that actively short stocks to hedge their positions. Widespread shorting—when you borrow a share, sell it, and hope to buy it back at a lower price—ensures that longs (owners of the stock) are set against shorts in a zero-sum game. With the morality tale of good individual investors on Reddit battling the evil hedge funds shorting stocks, the game was complete. In a populist moment, what could be more fun than seeing lethal combat between individuals and institutions, outsiders and insiders?

How did the gamification of financial markets happen? There are many culprits, including a bored and socially distanced workforce staring at screens during a pandemic, and low interest rates that make traditional saving silly and borrowing to buy stocks cheap, but the most important is the resurgence of the retail investor. You can’t fully gamify an industry without finding a technology to allow many new players.

In the last five decades, institutional investors became the dominant force in financial markets. The rise of defined benefit plans and then the switch to defined contribution plans consolidated market power among the mutual funds where workers invest retirement assets and the hedge funds that promise pension plans and endowment managers exorbitant returns. But that changed two years ago.

A fundamental change in the business model of financial brokerages brought the retail investor back: the rise of zero-commission trading. Commissions were already under pressure as new entrants—notably Robinhood—were funded by venture capitalists eager to find another industry to disrupt with bountiful capital. Brokerages realized that their business model was upside down. They didn’t need to charge their customers commissions to make money; there was much more money to be made by not charging their customers. The allure of “free”—demonstrated by Facebook and Google—was far greater than conventional business models.

As we’ve learned from the internet, what appears to be free is far from it. Just as Facebook and Google monetize user information by selling advertising, Robinhood and all the brokerages that have migrated to zero-cost commission capitalize on information. But there’s a twist. The brokerages don’t sell their users’ information; they sell their lack of it. The fundamental problem for market makers in financial markets is the danger of transacting with people with information—no one wants to trade with someone with more information because they know they’ll lose. That problem is what gives rise to so-called bid-ask spreads (the difference between the price at which you can buy and sell an asset) as these spreads reward market-makers for the risk of transacting with informed traders.

Robinhood and other zero-cost brokerages monetize their hold on active traders who are decidedly uninformed. They sell these trades to a new generation of market makers, like Citadel Securities, who pay for the ability to realize a bid-ask spread without taking the risk of trading with informed traders. Retail investors get to trade for free, the new generation of Wall Street behemoths like Citadel monetize their ignorance, and the old-line investment banks that used to pocket that bid-ask spread have moved on to becoming, like Goldman Sachs, some combination of a commercial bank and a hedge fund. Fun is had by all.

The gamification of financial markets comes with many costs. This will end badly for the retail investors, though it is not clear exactly when and how, and some will make money along the way. In the process, financial markets will do what they have done for centuries, though it is little acknowledged: reallocate wealth from the uninformed to the informed. Every bubble is associated with redistribution, and much of the alpha that professional investors boast about is nothing more than timing gains that are redistributions from other parties. The current populist moment in financial markets, like many other populist moments, will only serve to amplify that redistribution toward the rich and informed, all the while suggesting that it is doing the opposite.

Even more is at stake for the real economy. Financial markets are meant to provide price signals that help allocate resources and to provide mechanisms for funneling capital from savers to firms that need that capital. Gamification reduces those important functions to a sideshow. As retail investors reckon with their losses, they will lose faith in the valuable functions financial markets provide.

As with Facebook, or any seemingly “free” market, putting the genie back in the bottle will not be straightforward. It isn’t obvious how to regulate a market where participants are willingly trading their attention. Individuals are not being charged anything, and there is no obvious informational edge that is being capitalized on unfairly. Yet losses will arise over time and financial markets will suffer a further loss in credibility. Until that reckoning, your long-run health will be best served by being a fan and not a player—if you can stomach what the game is doing to the players, that is.

"Market" - Google News

January 31, 2021 at 04:00PM

https://ift.tt/2YsbuRH

With GameStop, Reddit and Robinhood gamified the stock market - Quartz

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Pence plans to form political group as he moves beyond time with Trump, Capitol riot - NBC News

WASHINGTON — Former Vice President Mike Pence is beginning to build a political future without Donald Trump, including making plans to form a policy-focused political committee that would help him maintain a relationship with donors, according to multiple sources familiar with his plans.

Pence, who left Washington and took a post-inauguration vacation with his wife in St. Croix ahead of resettling in Indiana, is expected to announce his new venture in the coming weeks, sources said.

To say the end of his time in office was rocky, would be to put it mildly. His relationship with Trump has been virtually non-existent since a mob of the former president's followers stormed the U.S. Capitol in a failed attempt to assassinate Pence and overturn the outcome of the election. Before the January 6 riot, Pence's time with Trump had been defined by the vice president's role as a loyal soldier.

After Pence and his family had to be rushed from the Senate chamber and hidden from the rioters, it has raised questions about whether he might testify in Trump’s upcoming impeachment trial, which will consider whether the former president was guilty of insurrection after encouraging his supporters to go the Capitol.

However, there have not been signals from lawmakers who will conduct the impeachment trial that Pence could be called as a witness, like discussion of conducting depositions or preparing a statement.

And those close to Pence think his legal counsel would argue he has executive privilege, according to one Republican source. Executive privilege is the constitutional protection that prohibits the legislative branch from compelling testimony from the executive branch.

But it remains unclear whether the staff who were with Pence on Jan. 6th, and who experienced the riot as well, would also be able to invoke executive privilege.

Pence also seems prepared to start a new chapter and move on.

Within the next month, he is likely to announce the formation of a political organization known as a 501(c)4 to amplify his positions on a “consistent conservative philosophy,” as one person familiar with the plan described it. A 501(c)4 group can be active on political issues, but are not allowed to engage in campaigning. That type of group may also keep their donors secret.

Starting his own group would give Pence a foothold in the fundraising world, allowing him to maintain relationships with donors in case he decides in 2024 to run for president.

Pence is not expected make an announcement about his own future campaigns until after the 2022 midterms, and advisers caution he has not made a final decision about whether to run.

Pence may write a book. And he’s expected to hit the campaign trail ahead of the 2022 races to support Republican candidates, particularly in the gubernatorial races.

Trump has been suggesting to allies he’s eager to get involved in primaries against Republicans who feel have wronged him, according to sources familiar with those discussions. But Pence sources say the former vice president hasn't discussed the potential of backing incumbents in opposition of Trump.

“That’s a long way off,” said one of the people familiar with Pence’s thinking.

Pence is opting to remain out of the public eye for the moment.

The Pences don't own a home after having spent the previous four years living in the vice presidential residence and the four before that in the Indiana governor's residence.

He plans to stay temporarily with a family member in Indiana until he buys a home in the state later this year and plans to make that his permanent home.

He remains protected by the Secret Service, which is typical for former vice presidents, but takes on added significance after the attempts on his life.

Pence allies remain furious that Trump never reached out to Pence while he was hidden in the Capitol, and by most accounts the relationship between the two is a shell of what it once was.

But the two men may take the same stage once again later this spring: the Republican National Committee has invited Trump and other 2024 hopefuls — including, potentially, Pence — to their spring meeting in Palm Beach in April.

"politic" - Google News

January 31, 2021 at 05:00PM

https://ift.tt/3r8rgNW

Pence plans to form political group as he moves beyond time with Trump, Capitol riot - NBC News

"politic" - Google News

https://ift.tt/3c2OaPk

https://ift.tt/2Wls1p6

WHO teams visits Wuhan food market in search of virus clues - ABC News

A World Health Organization team looking into the origins of the coronavirus pandemic is visiting a market known to be the food distribution center for the Chinese city of Wuhan during the 76-day lockdown last year

By EMILY WANG FUJIYAMA and ZEN SOO Associated Press

January 31, 2021, 9:23 AM

• 2 min read

WUHAN, China -- A World Health Organization team looking into the origins of the coronavirus pandemic on Sunday visited the seafood market in the Chinese city of Wuhan that was linked to many early infections.

The team members visited the Huanan Seafood Market for about an hour in the afternoon, and one of them flashed a thumbs up sign when reporters asked how the trip was going.

The market was the site of a December 2019 outbreak of the virus. Scientists initially suspected the virus came from wild animals sold in the market. The market has since been largely ruled out but it could provide hints to how the virus spread so widely.

“Very important site visits today — a wholesale market first & Huanan Seafood Market just now," Peter Daszak, a zoologist with the U.S. group EcoHealth Alliance and a member of the WHO team, said in a tweet. “Very informative & critical for our joint teams to understand the epidemiology of COVID as it started to spread at the end of 2019.”

Earlier in the day, the team members were also seen walking through sections of the Baishazhou market — one of the largest wet markets in Wuhan — surrounded by a large entourage of Chinese officials and representatives. The market was the food distribution center for Wuhan during the city's 76-day lockdown last year.

The members, with expertise in veterinary medicine, virology, food safety and epidemiology, have so far visited two hospitals at the center of the early outbreak — Wuhan Jinyintan Hospital and the Hubei Integrated Chinese and Western Medicine Hospital.

On Saturday, they also visited a museum exhibition dedicated to the early history of COVID-19.

The mission has become politically charged, as China seeks to avoid blame for alleged missteps in its early response to the outbreak.

A single visit by scientists is unlikely to confirm the virus’s origins. Pinning down an outbreak’s animal reservoir is typically an exhaustive endeavor that takes years of research including taking animal samples, genetic analysis and epidemiological studies.

One possibility is that a wildlife poacher might have passed the virus to traders who carried it to Wuhan. The Chinese government has promoted theories, with little evidence, that the outbreak might have started with imports of frozen seafood tainted with the virus, a notion roundly rejected by international scientists and agencies.

———

Soo reported from Hong Kong.

"Market" - Google News

January 31, 2021 at 11:23AM

https://ift.tt/2YwbUXa

WHO teams visits Wuhan food market in search of virus clues - ABC News

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

Search

Featured Post

Politics - The Boston Globe

unitedstatepolitics.blogspot.com Adblock test (Why?) "politic" - Google News February 01, 2024 at 03:47AM https://ift.tt...

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/VNG7YMZTRWJ5WBFTJ5NVETPCQI.jpg)

Postingan Populer

-

unitedstatepolitics.blogspot.com ORLANDO, Fla. – Whether choosing to resign or being ousted by newly-elected school boards, superintenden...

-

unitedstatepolitics.blogspot.com Trump's GOP Support Softens & Hunter Biden’s Plea Deal - CNN Political Briefing - Podcast on CNN A...

-

unitedstatepolitics.blogspot.com Calls to speed the development of the electric grid might sound familiar to George W. Bush. The former R...