Fox Business Flash top headlines are here. Check out what's clicking on FoxBusiness.com.

More than 20 million Americans are out of work and receiving unemployment benefits, largely due to the COVID-19 pandemic. And yet, you wouldn't know that there's a problem in the economy from looking at the markets. The S&P 500 is up over 5% since March 1, which is around the time the coronavirus was just starting to wreak havoc on the U.S.

Continue Reading Below

HEALTH, TECH STOCKS DRIVING MARKETS: INVESTING EXPERT

Stocks have by and large recovered from the crash that took place that month. But that's also precisely why another market crash is inevitable: Investors are overvaluing stocks and likely aren't factoring in the long-lasting implications of the current recession. It's not a matter of if there will be another crash, but when. And if you don't want to see your portfolio take a big hit when it happens, you'll want to avoid hanging on to these three stocks:

1. Aurora Cannabis

Aurora Cannabis is a volatile investment whether there's a market crash or not. It's lost half its value this year and the company had to do a 12-for-1 reverse split in May to keep its stock price above the $1 mark to avoid getting delisted from the NYSE. A reverse split isn't a sign things are going well. However, Aurora is hoping to turn things around relatively quickly.

WHY MILLENNIAL INVESTORS ARE BUYING AURORA CANNIBIS AND CRONOS GROUP ABOVE ALL OTHER POT STOCKS

Stocks in this Article

$13.72

+0.35 (+2.62%)

The company's expecting to be profitable by the first quarter of fiscal 2021. That means for the period of July through September, Aurora is expecting to have a profitable earnings before interest taxes depreciation and amortization (EBITDA) figure. That's not that far away, and a lot has to go right for that to happen. It would have to be a best-case scenario for Aurora to hit its targets given the uncertainty that the COVID-19 pandemic has caused thus far.

In the third-quarter results Aurora released on May 14, it incurred an adjusted EBITDA loss of 50.9 million Canadian dollars. That's improved from the CA$80.2 million loss it posted in the previous quarter but it was a deeper loss than the CA$36.6 million loss it reported in the third quarter last year.

If sales don't rise during what's still a very volatile period, and if Aurora can't keep its costs down, the company could fall short of its expectations. There are too many ifs involved to be optimistic about the company's chances. And what's worse is even if the Ontario-based pot producer pulls a rabbit out of the hat by posting a profit, it may all be for naught.

WHO IS MORE LIKELY TO SMOKE MARIJUANA?

A market crash could send investors heading for safety and stocks that are stable (e.g. not cannabis stocks). Shares of Aurora are down 85% in just one year and even the Horizons Marijuana Life Sciences ETF has plummeted 60% during that time. If there's a run on the markets, highly volatile pot stocks like Aurora could go into free fall, even if the company meets its ambitious targets for Q1.

2. Kohl's

Kohl's is a bit of a safer buy than a pot stock, but not by much. Retail stocks may be a bit less volatile but they're still risky. Some big-name companies have already filed for bankruptcy this year, including J.C. Penney, J.Crew, Neiman Marcus, and Pier 1 Imports. And more are likely on the way.

Stocks in this Article

$21.94

-0.31 (-1.39%)

The Wisconsin-based retailer released its first-quarter results on May 19, and they were dreadful. For the three-month period ending May 2, the company's sales were down 40.6% from the prior-year period. It incurred a net loss of $541 million compared to a profit of $63 million a year ago. Losses are rare for Kohl's as it's been profitable in each of the nine periods prior to Q1 -- although its net margin typically doesn't come in higher than 4%.

CORONAVIRUS FORCES KOHL'S TO ABANDON JENNIFER LOPEZ, SEVEN OTHER BRANDS

There's just not a lot of margin for error or for things to go wrong. And during a recession, there's a lot that can go off the rails. Throw widespread lockdowns and a market crash into the equation combined with the pessimism surrounding retail and Kohl's awful Q1 results, and the stock could spiral down to a new low for the year.

Kohl's has lost half of its value in the past year and the company's also suspended its dividend. And there's little reason to be optimistic the stock will turn things around anytime soon.

CORONAVIRUS COMPOUNDS RETAILER WORRIES AFTER LACKLUSTER HOLIDAY

3. Tesla

Tesla is the one company on this list that's actually doing well this year. Investors have been happy with the stock as it's posted a profit in three straight quarters. Prior to that, Tesla incurred losses in five of its last seven reporting periods.

Stocks in this Article

$994.32

-6.58 (-0.66%)

The electric automaker's been posting surprising results with not just profits, but in delivering more cars than expected. On Jan. 3, the company announced that during the fourth quarter it delivered 112,000 vehicles -- a record for the Palo Alto, Calif.-based business. For the year, it delivered 367,500 vehicles, 50% more than the 245,240 that it delivered in 2018. For 2020, prior to the COVID-19 pandemic, the company was projecting to hit well over 500,000 delivered vehicles. However, that number is now in doubt.

TESLA EYEING SIGNIFICANT TAX BREAKS AS IT CONSIDERS TAX PLANT

There's been even more bullishness this month after CEO Elon Musk indicated that the company's electric semi-trucks would also start to see production ramp up, although it's not clear when that might happen.

But it's that euphoria that makes the stock too hot to hold on to right now. If you've made a good profit from owning shares of Tesla, it might be a good time to consider cashing out. The stock closed at over $1,000 a share on Thursday, not far from its all-time high of $1,027.48. With the stock trading at 20 times its book value, it's definitely overheating and it could be due for a big sell-off once the markets cool off.

ELON MUSK PERPLEXED OVER TESLA'S SKY-HIGH STOCK

Tesla isn't a bad stock to own, it's just far too expensive to hold in your portfolio today.

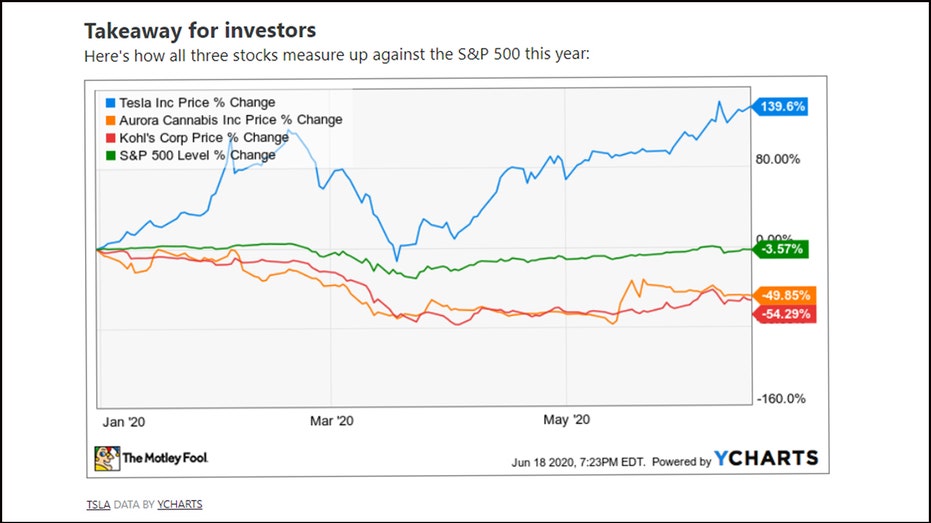

Takeaway for investors

CLICK HERE TO GET FOX BUSINESS ON THE GO

Here's how all three stocks measure up against the S&P 500 this year:

Even though Tesla's outperformed the other two stocks on this list, it's just as risky of an investment to hold right now. A market crash can come without warning, and when it does, all three of these stocks could be on their way down. Investors are better off investing in safer stocks until the economy recovers from COVID-19.

CLICK HERE TO READ MORE ON FOX BUSINESS

"Market" - Google News

June 22, 2020 at 11:48PM

https://ift.tt/37STrYP

3 stocks you don't want to be holding when the market crashes again - Fox Business

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/VNG7YMZTRWJ5WBFTJ5NVETPCQI.jpg)

No comments:

Post a Comment