Stocks looked headed for a nervy start to trading Monday after the biggest two-day slide for global equities since June left investors on edge. Currencies began the week with little fanfare, while crude oil declined.

Futures pointed to modest losses in Japan and Australia, and S&P 500 futures retreated. U.S. markets are shut Monday for a holiday after the worst week for the Nasdaq since March. The dollar was steady in early trading, while the pound ticked lower going to another round of Brexit negotiations. Hong Kong markets will be in focus after protests again flared up on the city’s streets Sunday.

“Risk assets remain fragile following Thursday’s tech-led rout and volatility spike,” said Ben Emons, managing director for global macro strategy at Medley Global Advisors. “With stimulus having been key for supporting equities and such lofty valuations, its renewal will be crucial not only for the recovery, but as a driver for equities as job risks mount.”

Traders are on tenterhooks as the week kicks into gear and they continue to chart the path for a global economy dealing with a pandemic. Federal Reserve Chairman Jerome Powell responded positively to Friday’s U.S. employment data, but reiterated his view that the economic recovery has a long road ahead. One big event later this week is the European Central Bank’s policy meeting.

Here are some key events coming up:

- The next Brexit negotiating round begins with face-to-face discussions between the U.K. and the EU in London.

- The ECB will probably hold rates on Thursday but indicate that downside risks have intensified, suggesting further easing is possible before year-end.

- U.S. CPI data is due Friday, with consumer prices expected to rise in August for a third straight month.

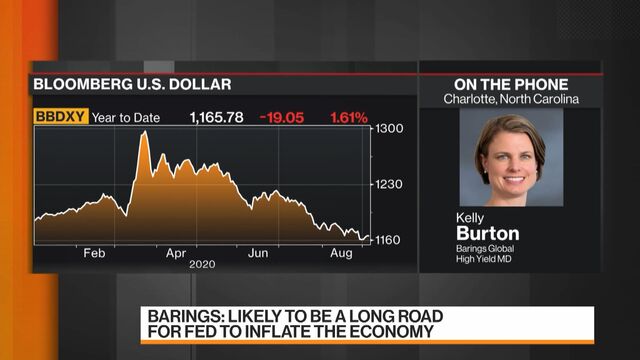

Kelly Burton at Barings says there’s opportunity for credit spreads to trend tighter.

Source: Bloomberg

These are the main moves in markets:

Stocks

- S&P 500 futures fell 0.5% as of 7:12 a.m. in Tokyo. The index fell 0.8% on Friday.

- Futures on Japan’s Nikkei 225 fell 0.4%.

- Hang Seng Index futures ended the Friday session little changed.

- Futures on Australia’s S&P/ASX 200 Index lost 0.6%.

Currencies

- The yen was flat at 106.24 per dollar.

- The euro held at $1.1840.

- The offshore yuan was at 6.8389 per dollar.

- The pound slipped 0.2% to $1.3257.

Bonds

- The yield on 10-year Treasuries climbed eight basis points to 0.72% on Friday.

Commodities

- West Texas Intermediate crude declined 1.5% to $39.24 a barrel.

- Gold diped 0.1% to $1,932.36 an ounce.

— With assistance by Nancy Moran

"Market" - Google News

September 07, 2020 at 03:58AM

https://ift.tt/2F3mrmw

Stock Market Today: Dow, S&P Live Updates for Sept. 7, 2020 - Bloomberg

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/VNG7YMZTRWJ5WBFTJ5NVETPCQI.jpg)

No comments:

Post a Comment