On Tuesday, the CME Group's soybean market is staging a rally.

In early trading, the Dec. corn futures are 3 3/4¢ higher at $3.83 1/4. March corn futures are 4¢ higher at $3.93 1/4.

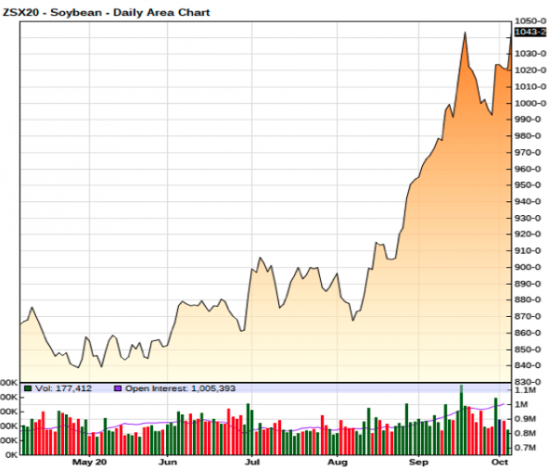

Nov. soybean futures are 16¢ higher at $10.37. January soybean futures are 14 3/4¢ higher at $10.39 3/4.

Dec. wheat futures are 5 1/2¢ higher at $5.89.

Dec. soymeal futures are $6.30 per short ton higher at $352.30. Dec. soy oil futures are $0.47 cent higher at 33.03¢ per pound.

In the outside markets, the NYMEX crude oil market is $1.38 per barrel higher at $40.60. The U.S. dollar is lower, and the Dow Jones Industrials are 66 points higher.

On Tuesday, Private exporters reported to the USDA export sales of 154,400 metric tons of soybeans for delivery to unknown destinations during the 2020/2021 marketing year.

The marketing year for soybeans began Sept. 1.

The USDA weekly crop report on Monday afternoon showed corn ratings up 1% (at 61%) good to excellent. Soybean ratings were unchanged. Corn harvest was reported at 25% complete and nationwide soybean harvest was reported at 38%.

Al Kluis, Kluis Advisors, says that this is the time of the year that investors consider the harvest pace.

"Soybean harvest will pass 55% nationwide in the USDA Crop Progress report next Monday. That will force elevators and end users to start pushing basis bids to lock in the soybeans they need to buy from farmers before the beans go to the bin," Kluis told customers in a daily note.

He added, "Watch the low made last Friday in November soybeans at $10.13. That is the key two-day low. The two-week low at $9.85 held last week, and is now major support. A close below $10.13 on Tuesday or Wednesday will signal a short-term top."

-------------------

Monday's Grain Market Review

On Monday, the CME Group’s farm markets diverge.

At the close, the Dec. corn futures finished ¼¢ lower at $3.79¼. March corn futures closed unchanged at $3.89¼.

Nov. soybean futures closed ¾¢ higher at $10.21¾. January soybean futures ended ¼¢ higher at $10.25.

Dec. wheat futures ended 11¢ higher at $5.84¼.

Dec. soymeal futures settled $5.90 per short ton lower at $346.00. Dec. soy oil futures finished 0.90¢ higher at 32.56¢ per pound.

In the outside markets, the NYMEX crude oil market is $2.10 per barrel higher at $39.15. The U.S. dollar is lower, and the Dow Jones Industrials are 376 points higher.

On Monday, private exporters reported to the USDA export sales of 160,020 metric tons of corn for delivery to Mexico during the 2020/2021 marketing year.

The marketing year for corn began Sept. 1.

Jack Scoville, PRICE Futures Group, says that the corn and bean markets are trading in ranges and are waiting for the harvest progress reports, today, and the WASDE at the end of the week.

“Past history suggests that USDA will come in below the average trade guess, so the market could rally again on Friday or maybe next week. But it should be a choppy affair until then or unless the yield reports from the country are very good and high,” Scoville says.

“The wheat market is up on weather, dry conditions in Russia, the U.S. Plains, and Argentina and Australia. All in all, the wheat market is held up by less production coming and fund buying,” Scoville says.

Al Kluis, Kluis Advisors, says that the funds are expected to get longer the markets, pushing up prices.

“Even with the lower corn and soybean market on Friday, the corn and soybean markets closed higher for the week. The lower markets last Monday and Tuesday are a correction in the overall bull market,” Kluis told customers in a daily note.

He added, “The USDA Crop Progress report today will show corn harvest at about 25% and soybean harvest at 35%. With dry weather forecasts for the next two weeks, I expect a fast wrap-up to the corn and soybean harvest this year. I look for soybean harvest to be at 50% in two weeks, and corn harvest to be at the 50% mark in three weeks.”

"Market" - Google News

October 06, 2020 at 08:52PM

https://ift.tt/3d1V4pz

Soybean market shoots up 16¢ Tuesday - Successful Farming

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/VNG7YMZTRWJ5WBFTJ5NVETPCQI.jpg)

No comments:

Post a Comment