U.S. stock futures opened higher after a rally fizzled in the regular session with earnings continuing to roll in, while Asian equities edged lower. Treasuries held overnight losses and crude oil extended its advance.

Japan, South Korea and Australia saw small declines. S&P 500 futures were up 0.2% after the gauge pared gains Wednesday to close barely in the green following its biggest two-day rally in almost three months, while the Nasdaq 100 finished lower. Google’s parent Alphabet Inc. hit a record on stellar results, while Amazon.com Inc. slumped.

Oil continued its ascent as OPEC+ said it will keep pushing to quickly clear the surplus left behind by the pandemic. A widely watched segment of the Treasury yield curve reached its steepest level in almost five years on Wednesday. The dollar was little changed.

Investors are mulling scattered signs of a pickup in U.S. activity amid a push from President Joe Biden to win congressional passage of a $1.9 trillion stimulus proposal. Data showed companies added more jobs than forecast in January, while growth at service providers accelerated. Federal Reserve Bank of St. Louis President James Bullard said stock prices reflect optimism about the economic recovery.

“There has been a ton of noise in the stock market these past few weeks, so it’s encouraging to see solid economic reads,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial Corp. “There may be signs of overextension when it comes to single stocks, but under the surface there is an economy regaining serious momentum.”

Elsewhere, GameStop Corp., the poster child for Redditors looking to squeeze short sellers, and movie-theater chain AMC Entertainment Holdings Inc. rebounded following Tuesday’s plunge. After the close of regular trading, Qualcomm Inc. tumbled as the biggest maker of chips that connect smartphones to wireless networks reported disappointing sales. EBay Inc. climbed as profit topped Wall Street estimates while PayPal Holdings Inc. surged after forecasting strong revenue.

These are some key events coming up:

- The Bank of England sets rates on Thursday and an Indian central bank policy decision is due Friday.

- The U.S. January payrolls report is due Friday.

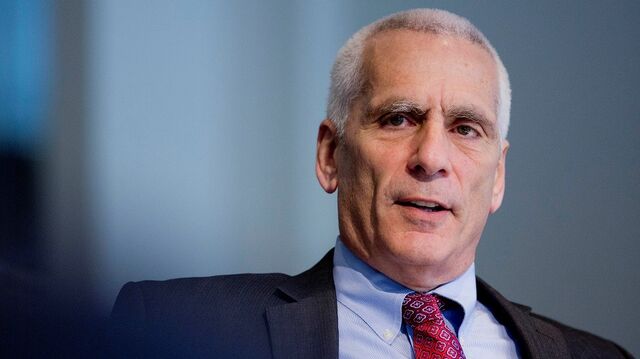

Jared Bernstein, a member of the White House Council of Economic Advisers, discusses President Joe Biden’s American Rescue Plan.

Source: Bloomberg

These are some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 9:03 a.m. in Tokyo. The gauge advanced 0.1% on Wednesday.

- Japan’s Topix index was little changed.

- South Korea’s Kospi lost 0.3%.

- Australia’s S&P/ASX 200 Index slipped 0.3%.

Currencies

- The Bloomberg Dollar Spot Index was little changed.

- The euro bought $1.2039.

- The yen was little changed at 105.03 per dollar.

- The offshore yuan was at 6.4579 per dollar.

Bonds

- The yield on 10-year Treasuries was at 1.14%.

- Australia’s 10-year yield was at 1.21%.

Commodities

- West Texas Intermediate crude increased 0.3% to $55.85 a barrel.

- Gold was at $1,833.61 an ounce.

"Market" - Google News

February 04, 2021 at 05:09AM

https://ift.tt/36ImDCa

Stock Market Today: Dow, S&P Live Updates for Feb. 4, 2021 - Bloomberg

"Market" - Google News

https://ift.tt/2Yge9gs

https://ift.tt/2Wls1p6

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/VNG7YMZTRWJ5WBFTJ5NVETPCQI.jpg)

No comments:

Post a Comment